Insurance

VSP News and Updates

Updated Dispute Resolution Procedure Effective January 1

To comply with new California legislation and better align with the state’s rules around claim disputes, VSP has announced changes to its Dispute Resolution Procedure (DRP) effective January 1, 2019.

The DRP, which is part of the VSP Network Doctor Agreement (NDA), outlines how VSP and doctors who participate on its network agree to resolve various kinds of adverse actions including claim disputes.

As an organization that always seeks to comply with state and federal laws and regulations governing its business, VSP worked extensively with the California Department of Managed Health Care (DMHC) during the past several months to update its approach. The DMHC, which oversees managed healthcare in

California, had advised VSP to modify the DRP to better align with state laws and regulations governing fraud and non-fraud related claim disputes.

The new DRP also meets the requirements of legislation that changed California’s Health and Safety Code. The legislation, which was backed by VSP and signed into law by Governor Brown in September, ensures more transparency for doctors and insurers in the process to audit, discover and

address fraud. It also spells out important elements such as the use of statistical extrapolation to identify suspect claims and the length of time auditors may look back when using extrapolation.

As of January 1, 2019, VSP and the DMHC agreed to modify the current dispute process in two ways:

- First level of appeal: Doctors will have an additional level of appeal in writing. If not resolved through this process, the provider can request a peer review hearing and/or arbitration as it has done in the past.

- No current claim payment withholding: VSP will no longer withhold current claim payments as restitution during the dispute resolution process.

Because VSP is a California-based company, VSP must implement these changes nationally in order to remain in regulatory compliance.

A Letter of Agreement between VSP and the DMHC will appear on the agency’s website by the end of November. As part of the agreement, VSP will pay a one- time administrative penalty.

For questions about the DRP, please email Provider Network Development or call 800.742.6907 and select Option 3 to speak to a specialist.

Choice Network Doctors: Your Practice is Listed in the Cigna Vision and MetLife Vision

As a VSP® Choice Network provider, you’re listed in the Cigna®Vision and MetLife Vision provider directories. This means you can see patients who ask if you’re a Cigna Vision or MetLife Vision provider.

Please note that these patients only know their plan as Cigna Vision

or MetLife Vision. You’ll check eligibility, administer benefits, and be reimbursed just like a VSP Choice Plan®.

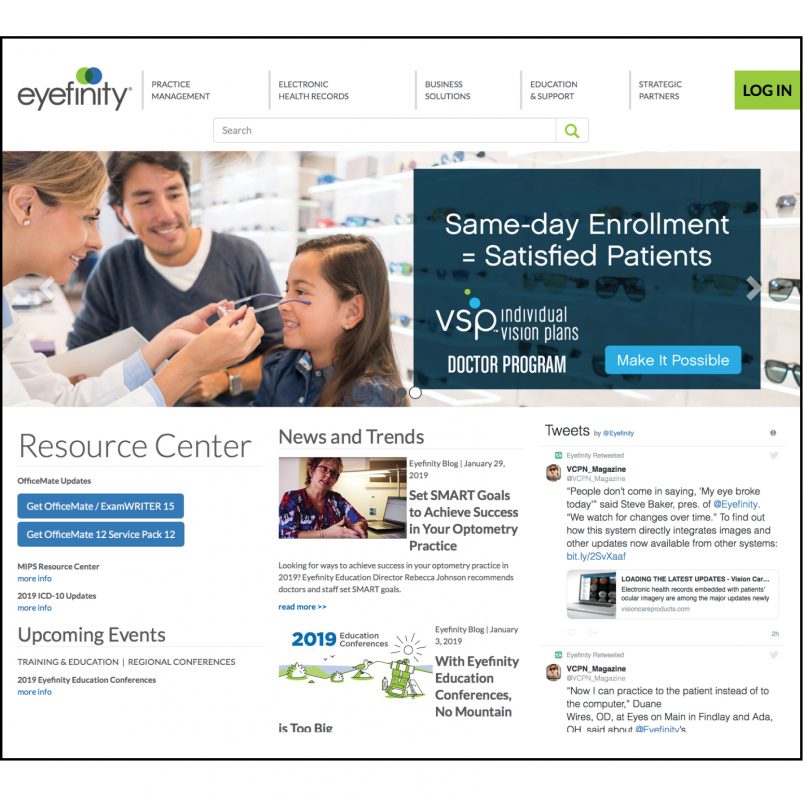

For more information, please refer to the Plans menu on VSPOnline through eyefinity.com and select

Cigna or MetLife. Or, refer to the client details page in your VSP Choice Plan Manual.

NEW: $10 More With Enhanced Featured Frame Benefit

Effective January 1, 2019, when a VSP® patient with an Enhanced Featured Frame benefit chooses a Marchon® or Altair® frame, practices meeting the VSP Global® Premier Program frame target will receive $20. This represents a $10 increase on top of the $10 you

already receive when a VSP patient selects a Marchon/Altair frame.

About the Enhanced Featured Frame benefit

To help win more clients and provide VSP network practices with more patients, VSP Vision Care has offered select clients the ability to increase their employees’ frame allowance for Marchon/Altair frames with the Enhanced Featured Frame benefit, typically an additional $50. As of January 2019, over 250 VSP clients and about 4 million VSP patients have this enhancement.

You’ll see the additional frame payment on your Explanation of Payment, listed on each qualifying claim as “Additional Frame Payment.”

Questions? Contact providernetworkdevelopment@vsp. com.