Practice Management

How to Pay An Employee Who Reports Experiencing COVID-19 Symptoms

This article was originally published on Review of Optometric Business and reprinted with permission.

By TSO Board Member Mark Wright, OD, FCOVD, and Carole Burns, OD, FCOVD

How does the Families First Coronavirus Response Act (FFCRA) help if an employee (or doctor) has been advised by a health-care provider to self-quarantine because of COVID-19 or is experiencing symptoms of COVID-19 and seeking a medical diagnosis?

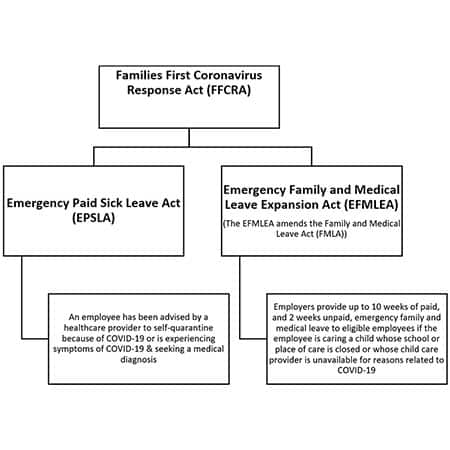

Both American employees and employers benefit from the relief found in the Emergency Paid Sick Leave Act and Emergency Family and Medical Leave Expansion Act, which are both part of the (FFCRA).i American private employers with less than 500 employees receive tax credits for the cost of providing employees with paid leave for specific reasons related to COVID-19. The goal of the law is to keep employees on the payroll and off unemployment by removing the need for employees to choose between working and public health measures put in place to combat the virus.

The following chart helps put the FFCRA into perspective.

We are only going to discuss provisions under the Emergency Paid Leave Sick Act (EPSLA) in this article. (If you want to know more about the EFMLEA, here’s an article explaining the difference between the FMLA and the EFMLEA.ii)

According to the EPSLA, the employee who has been advised by a health-care provider to self-quarantine because of COVID-19 or is experiencing symptoms of COVID-19 and seeking a medical diagnosis should self-quarantine for 14 days. During that time, the employer is to pay them 100 percent of their normal pay.

Employees are defined as owner, associate, staff, those paid salary or hourly, and full or part-time. In other words, it’s any employee of yours on or after April 1, 2020.

There is a cap on what to pay your employee who is under the EPSLA. There is a $511 maximum per day per employee pay limit, and a $5,110 maximum aggregate per employee.

Here are four examples of how to calculate what to pay:

And, finally, three rules to know:

References

i. https://www.dol.gov/agencies/whd/ffcra#:~:text=TheDepartmentpromulgatedregulationstoimplementpublichealth,aresettoexpireonDecember312020

ii. https://www.fclaw.com/insights/newsletters/2020/understanding-the-emergency-family-medical-leave-expansion-act-and-emergency-paid-sick-leave-in-the-families-first-coronavirus-response-act