Marketing & Advertising

It’s Not too Late to Create your Budget for 2024

Although we are three months into the year, it is not too late to work on a budget that helps you run a successful practice. Creating a budget keeps you on track with your overall practice strategy and prevents you from overspending, which will bottom-line reduce your profitability.

Learning to create a practice budget is the first step to keeping your practice profitable and in shape for long-term growth. We all know a budget helps the practice move forward, yet less than 20 percent of practices have a budget. Obviously, practices are surviving without a budget, so what’s the big deal? The answer to that question is the difference between a successful practice and an average practice. Simply stated, paying attention to details is the difference between being successful and being average.

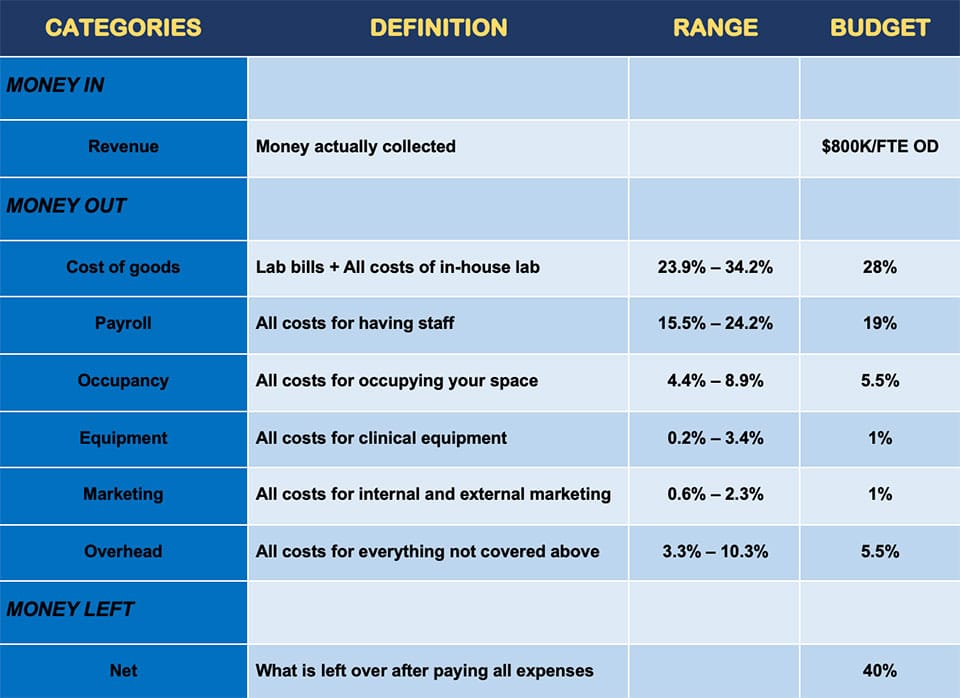

Let me show you how easy it is to create a budget. If you want a net of 40 percent, then run your practice as close to the budget categories in the chart below as possible.

Let’s define each budget category.

Revenue: This is the money actually collected. This is not money billed, because money billed is an imaginary number.

Cost of Goods: If you bought it from a lab and you are selling it to patients, then the expense for your purchases goes into this category. If you have an in-house finishing or edging lab, then all costs to run it go here (eg: rent for the space it occupies, payroll for the staff that work in it, leases or loans for the equipment).

Payroll: The entire cost to have your non-doctor staff (e.g.: wages, bonuses, benefits, uniforms, retirement).

Occupancy: The entire cost of occupying your space (e.g.: rent, cleaning, maintenance). Note: If you own your building, you should be paying yourself rent.

Equipment: All costs for your clinical equipment (e.g.: OCT, phoropters, slit lamps). NOTE: No lab edging or finishing equipment costs go here–they go in cost of goods.

Marketing: All costs for your internal and external marketing.

Overhead: Anything not included in the categories above is placed in overhead.

Net: Subtract your expenses from your revenue and what is left over is your net. You will pay all of your doctors–including yourself as a doctor–out of your net.

TO TAKE CONTROL OF YOUR PRACTICE, FOLLOW THESE THREE EASY STEPS.

STEP 1: Use the chart in this article to create your budget. As you take control of your practice, you can add more detail to your budget.

STEP 2: Tell your CPA to set up the practice profit and loss (P&L) statements using the categories in the chart in this article and then have your CPA provide you with monthly P&Ls. Use these monthly P&Ls to chart your progress toward your budget goals.

STEP 3: Create and implement action plans to keep your practice within your budget goals.

Now it’s up to you. If you want to move your practice to the next profitability level, start with these three easy steps.